Easy Access

to Peer-to-Peer Returns.

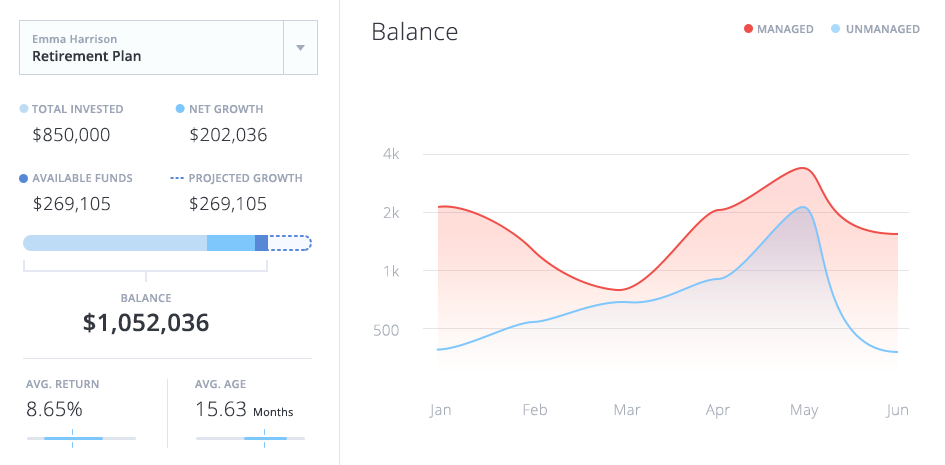

Whether your client is seeking yield for growth or a stable income stream, NSR provides integrated access to stable returns from lending to prime borrowers.

The available technology solutions have made it impossible for advisors to effectively allocate assets towards P2P investing… but that is now about to change.”

Fixed Income Allocation

It’s no secret that fixed income returns can barely keep up with inflation these days. By introducing peer-to-peer lending to the portfolio, advisors can help their clients normalize their fixed income allocation. An industry veteran, Michael Kitces discusses NSR Invest and p2p for financial advisors.

Diversify Client Portfolios

As notable research has shown, alternatives such as peer-to-peer lending can help portfolios to reach a higher point on the efficient frontier. Unlike traditional equities and bonds which are sensitive to the expectations of Wall Street, peer-to-peer lending returns are correlated to the changes within the real economy.

How it Works

folder_open Open Accounts

arrow_forward

attach_money Transfer Funds

arrow_forward

exit_to_app Invest Capital

arrow_forward

pie_chart Reporting

arrow_forward

receipt Fees & Billing

Intro to P2P Lending

Get In Touch!

Write us an email: team@nsrinvest.com